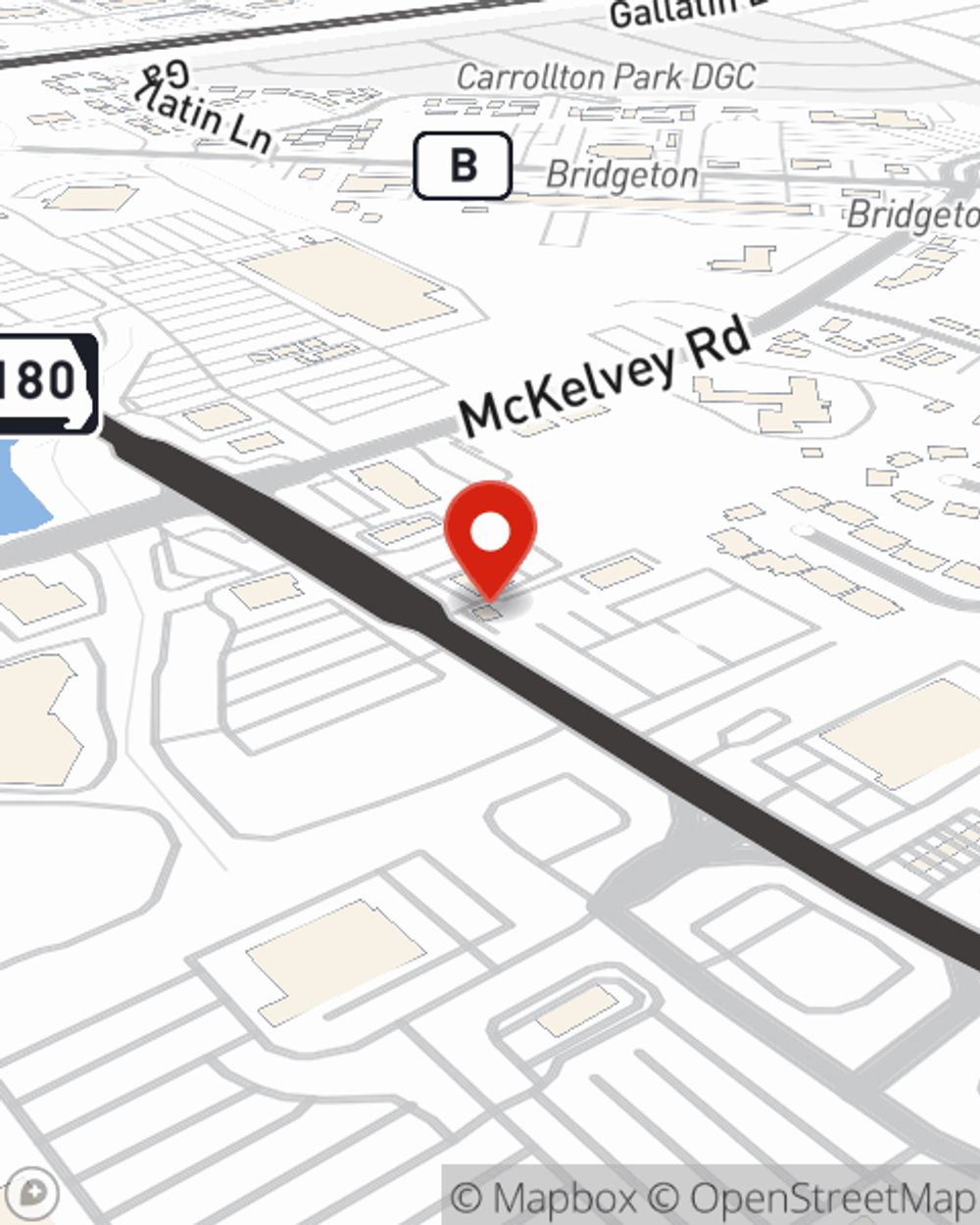

Business Insurance in and around Bridgeton

One of Bridgeton’s top choices for small business insurance.

Cover all the bases for your small business

- Bridgeton, MO

- St Charles Rock Road

- St Louis, MO

- St Ann, MO

- Maryland Heights, MO

- Florissant, MO

- Hazelwood, MO

- Creve Coeur, MO

- St Charles, MO

- St Peters, MO

- O'Fallon, MO

- Portage De Sioux, MO

- Robertsville, MO

- Des Peres, MO

- Ladue, MO

- Kirkwood, MO

- Fenton, MO

- St Charles County, M

- St Louis County, MO

- Ballwin, MO

Cost Effective Insurance For Your Business.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

One of Bridgeton’s top choices for small business insurance.

Cover all the bases for your small business

Cover Your Business Assets

Being a business owner requires plenty of planning. Since even your brightest plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your hard work with coverage like worker's compensation for your employees and extra liability. Terrific coverage like this is why Bridgeton business owners choose State Farm insurance. State Farm agent Kathy Bowden can help design a policy for the level of coverage you have in mind. If troubles find you, Kathy Bowden can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and contact State Farm agent Kathy Bowden to discover your small business insurance options!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Kathy Bowden

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.